Business Cases

Because a good example is often better than a long explanation.

Lotus Bakeries

Business Description

Lotus Bakeries is a Belgium Fast Moving Consumer Goods (FMCG) company with a very strong brand called “Lotus” that produces and sells Speculoos. The group has furthermore an extremely strong positioning in the Out-of-Home market, where they positioned themselves as the product of choice to go with a coffee.

Strong branded FMCG are very good businesses: usually they benefit from high customer loyalty, therefore leading to recurring purchases and little price sensitivity. This enables to easily pass on price increase of raw material to customers. Furthermore, as the brand grows, it benefits from increasing return on its marketing expense.

Lotus has been created in 1932 and is still owned and run by the Boone Family.

All these characteristics are exactly what I tend to look for in a business.

Investment Thesis

At the beginning of the year 2000’s the company was mainly operating in Benelux and France (80% of their revenues). They launched a program to expand their presence outside of their core countries, with strong growth potential at the key.

Furthermore they achieved an Earnings Before Interest and Taxes (EBIT) margin of below 10% during that time. Well run and at scale FMCG businesses have the potential to achieve EBIT margin well above 10%.

Development

As of FY 2017 Lotus Bakeries generated ca. € 520m revenues compared to € 150m in 2004 (+250%). Close to 50% of the sales are generated outside France and Benelux. EBIT has increased from € 14m to € 90m over the same period (+550%) due to the progressive margin expansion.

In addition to a regular dividend, the shareholders would have benefitted from a significant share price appreciation. At the end of FY 2014, Lotus share price traded around € 100,- per share. As of December 2017, the share price was € 2.100,- (+2.000%). This corresponds to a coumpounding annual growth rate of 26% (excluding dividends).

Rightmove

Business Description

Rightmove is the UK leading online platform for Real Estate advertising. You could compare it to “Se Loger” in France.

Online platform, provided they reach a critical scale, are wonderful businesses to own. They are extremely profitable (and therefore cash generative), and traditionally benefit from network effects which makes it particularly hard for new entrants to compete. A network effect happens when the stakeholders using the platform both benefit from the large number of users at other hand of the channel. On a real estate website, the real estate agencies have a strong incentive to join the platform if you have a high number of visitors on the website. Conversely, the higher the number of real estate agencies advertising on the platform, the more interesting the platform become for the end customer. This usually leads to a “Winner takes all” situation.

In addition to that, Rightmove provided its customer with significantly better Return on Marketing vs. the traditional newspaper advertising.

Investment Thesis

The Return on Advertising being significantly lower than for any other medium, Rightmove had tremendous room to increase its prices regularly. In addition to increasing the number of real estate agencies (and the number of ads) on its platform, the company has kept on increasing its prices by ca. 10% p.a. And all this could be done at virtually no additional cost and investments to the group.

Development

Revenues stood at GBP 34m in FY 2006 vs 243m in FY 2017 (+615%). This was driven by 2 factors:

- an increase in the number of advertiser from 16,3k to 20,4k (+25%)

- but way more importantly by the average revenues per advertiser, which increased from GBP 192,- per month to GBP 922,- per month (+380%)

Secondly EBIT increased from GBP 14m to GBP 178m (+1.170%) due to the scale effect.

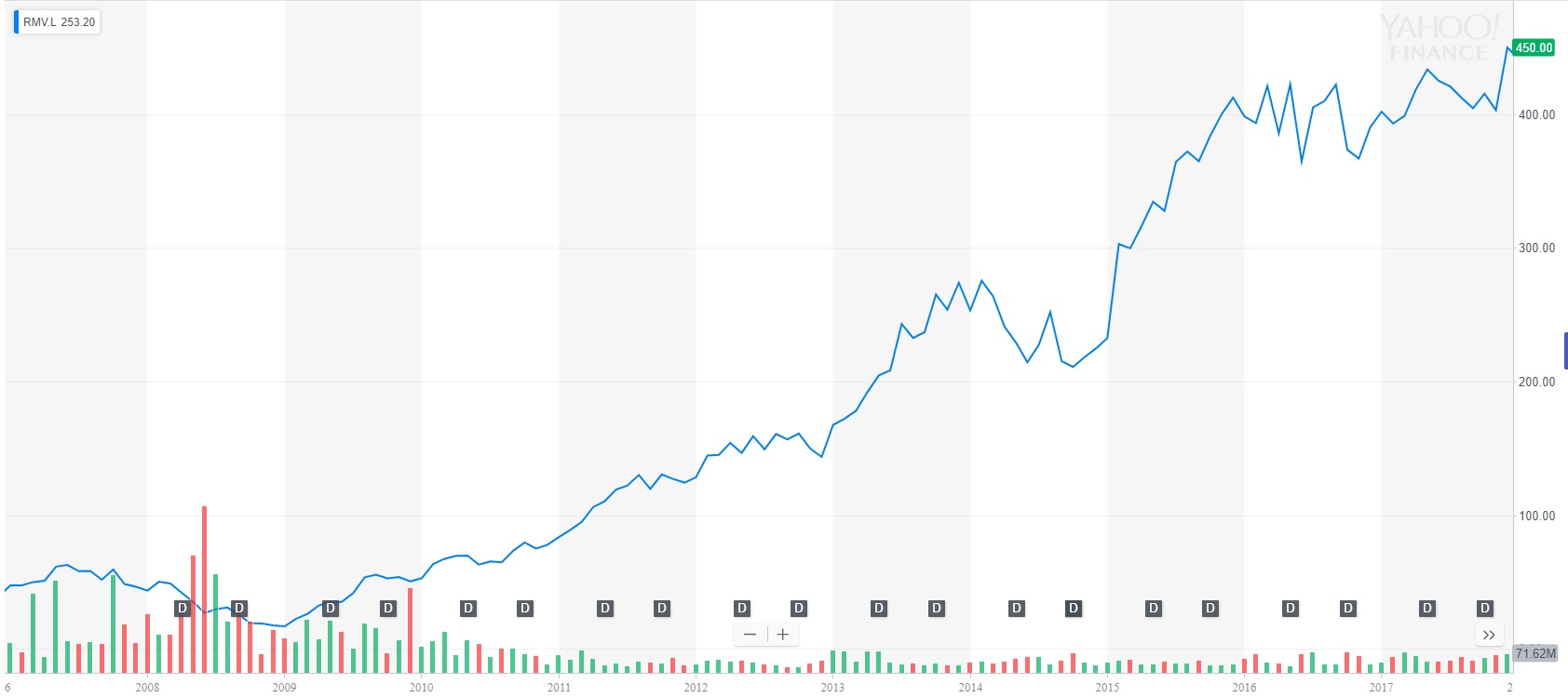

As little investments in CAPEX are needed for the business, Rightmove paid significant dividends to its shareholders. Furthermore share price over the period has increased from GBx 50,- to GBx 450 (+800%). This corresponds to a coumpounding annual growth rate of 22% (excluding dividends).